HST (Harmonized Sales Tax) :

HST (Harmonized Sales Tax) is a single tax implemented by the Canada Revenue Agency that combines the federal and provincial sales taxes into one. It makes paying tax simpler on goods and services in certain Canadian provinces.

I’m Tara Rebecca, an Ontario-based HST specialist. I help Canadians, especially in Ontario, easily calculate HST, GST, and sales taxes with clear, simple guidance.

Steps to Calculate HST Using This Tool:

- Select Your Province : Use the dropdown menu labeled “Province” to choose the Canadian province where the purchase is made.

- Enter the Amount : Type the value in the “Amount ($)” field, of your purchase before tax.

- For example, if your subtotal is $100, just enter

100.

- For example, if your subtotal is $100, just enter

- Click “Calculate” : Hit the “Calculate” button. The tool will instantly show:

- Federal Tax (5%)

- Provincial Tax (varies by province)

- Total HST

- Total Amount Payable

- Download Your Result (Optional) : After the result appears, you’ll see a “Download PDF” button. Click it if you want a copy of your calculation saved as a PDF for your records or accounting.

- Reset if Needed : Hit the “Clear” button . It will reset all fields and results.

Current HST Rates 2025

| Province | HST Rate | Federal Part | Provincial Part |

|---|---|---|---|

| New Brunswick | 15% | 5% | 10% |

| Newfoundland and Labrador | 15% | 5% | 10% |

| Nova Scotia | 15% | 5% | 10% |

| Ontario | 13% | 5% | 8% |

| Prince Edward Island | 15% | 5% | 10% |

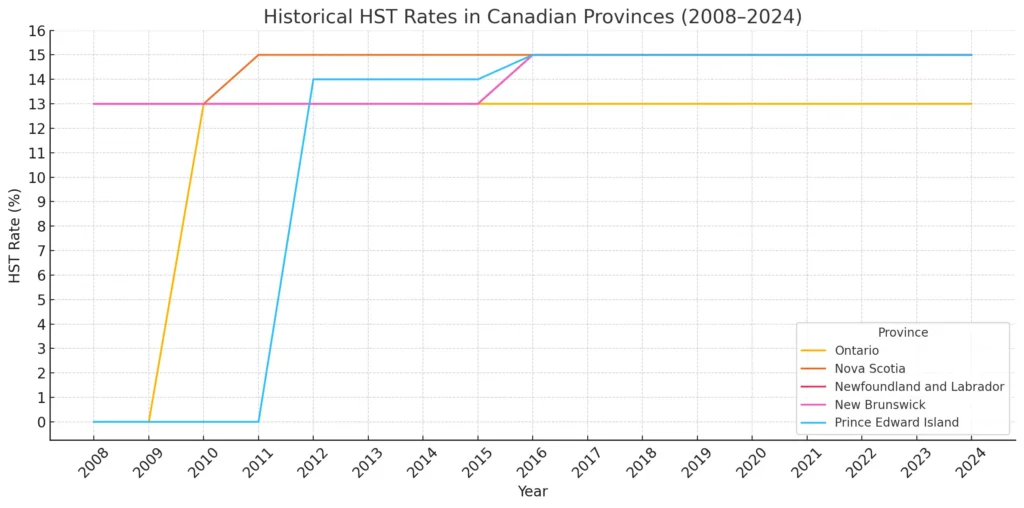

Historical HST Rates In Canadian Provinces (2008–2024)

The line chart above illustrates how Harmonized Sales Tax (HST) rates have evolved in five Canadian provinces from 2008 to 2024.

Key Observations:

- Ontario introduced HST in 2010 at 13% and has maintained it.

- Nova Scotia increased its rate to 15% in 2010, higher than the original.

- Newfoundland and Labrador and New Brunswick raised their rates to 15% in 2016.

- Prince Edward Island implemented HST later (2013) and increased it to 15% in 2016.